kurushar.ru

Market

Apps For Making Money

Survey Pop is the fastest, easiest way for making money from your phone. 82% of new members earn $5 sent to their PayPal within the first day of downloading. How does a free app make money without ads? If you don't want to include ads in your free application, you can still make money with it by utilizing one or a. Yes, there are several free money-making apps available. For example, Survey Junkie and Swagbucks are two free money-making apps that we gave high ratings. Another favorite game app to win real cash is Swagbucks. Swagbucks is a very popular rewards site where you can earn money by playing games, taking surveys. If you plan to earn money by making an app or mobile game, here you can find insights into mobile app monetization. Onix-Systems is a mobile app development. Monetize your website, app, or game. Try our tools to earn money through ads, in app-purchase, or subscription while delivering a great user experience. These legit apps are a quick and simple way to earn money with only a few clicks on your smartphone! Monetize your website, app, or game. Try our tools to earn money through ads, in app-purchase, or subscription while delivering a great user experience. This article will discuss some of the best apps to earn money, whether it be extra cash or full-time income. Survey Pop is the fastest, easiest way for making money from your phone. 82% of new members earn $5 sent to their PayPal within the first day of downloading. How does a free app make money without ads? If you don't want to include ads in your free application, you can still make money with it by utilizing one or a. Yes, there are several free money-making apps available. For example, Survey Junkie and Swagbucks are two free money-making apps that we gave high ratings. Another favorite game app to win real cash is Swagbucks. Swagbucks is a very popular rewards site where you can earn money by playing games, taking surveys. If you plan to earn money by making an app or mobile game, here you can find insights into mobile app monetization. Onix-Systems is a mobile app development. Monetize your website, app, or game. Try our tools to earn money through ads, in app-purchase, or subscription while delivering a great user experience. These legit apps are a quick and simple way to earn money with only a few clicks on your smartphone! Monetize your website, app, or game. Try our tools to earn money through ads, in app-purchase, or subscription while delivering a great user experience. This article will discuss some of the best apps to earn money, whether it be extra cash or full-time income.

We've tested the most popular money-making apps. Our goal was to discover which ones are legit and worth your time, ranking them based on their earning. kurushar.ru Earn money listening to music, installing apps etc ·: 10$ — $ ; TryMata. Get paid to use websites and apps and give your honest. 20 Money Earning Apps Without Investment For Students In · Earn Karo is one of the best apps for students to earn money by sending a link to their friends. Another favorite game app to win real cash is Swagbucks. Swagbucks is a very popular rewards site where you can earn money by playing games, taking surveys. Does anyone know of any apps or websites that are similar to the ones that involve taking surveys? Something i can do right now without having to apply for a. The Top 10 Money Earning Apps that Make You the Most Money · 1. Rakuten · 2. Dosh · 3. Ibotta · 4. Acorns · 5. Swagbucks · 6. HealthyWage · 7. Instacart · 8. What is the Best Money Making App? · Swagbucks · InboxDollars · MyPoints · Upromise · Tada. If you are looking to earn cash back on groceries Tada is the money-. Make Money from Home: 15 Apps That Pay You DAILY! · 1. Swagbucks · 2. InboxDollars · 3. TaskRabbit · 4. Gigwalk · 5. Uber Eats · 6. Instacart. IN THIS APP YOU CAN EASILY EARNED $ TO $ OER MONTH EASILY YOU CAN TRY THIS APP. The easiest way to earn money online is by joining EarnApp referrals and offers. Send over friends from YouTube, Facebook, and other media channels, to start. Free apps make money. You could always use the freemium model, which is popular in startups and gaming apps. With this method, the free version of your app. Givvy Videos is the ultimate cash-earning mobile solution that offers you an incredible opportunity to earn real cash rewards in your free time. See a full list of ways to earn Swagbucks · Search the web. It pays points for searching the web via its site instead of Google. · Install the Swagbucks toolbar. Honeygain is the first-ever app that allows its users to make money online by sharing their Internet connection. Reach your networks' full potential by getting. Top 'get paid to play' apps & websites · Mistplay – Android only, huge range of games. Short-Term Tasks Sites · kurushar.ru Ibotta is a cash-back app that allows users to earn money by making purchases at participating stores and scanning their. Ibotta is both a free app and browser extension that allows you to earn cash back on purchases at grocery stores, travel, online retailers and more. To sign up. How does a free app make money without ads? If you don't want to include ads in your free application, you can still make money with it by utilizing one or a. The best app for you will depend on how you want to earn money, whether that's through cash-back, surveys, gaming, or some other way. Ibotta is both a free app and browser extension that allows you to earn cash back on purchases at grocery stores, travel, online retailers and more.

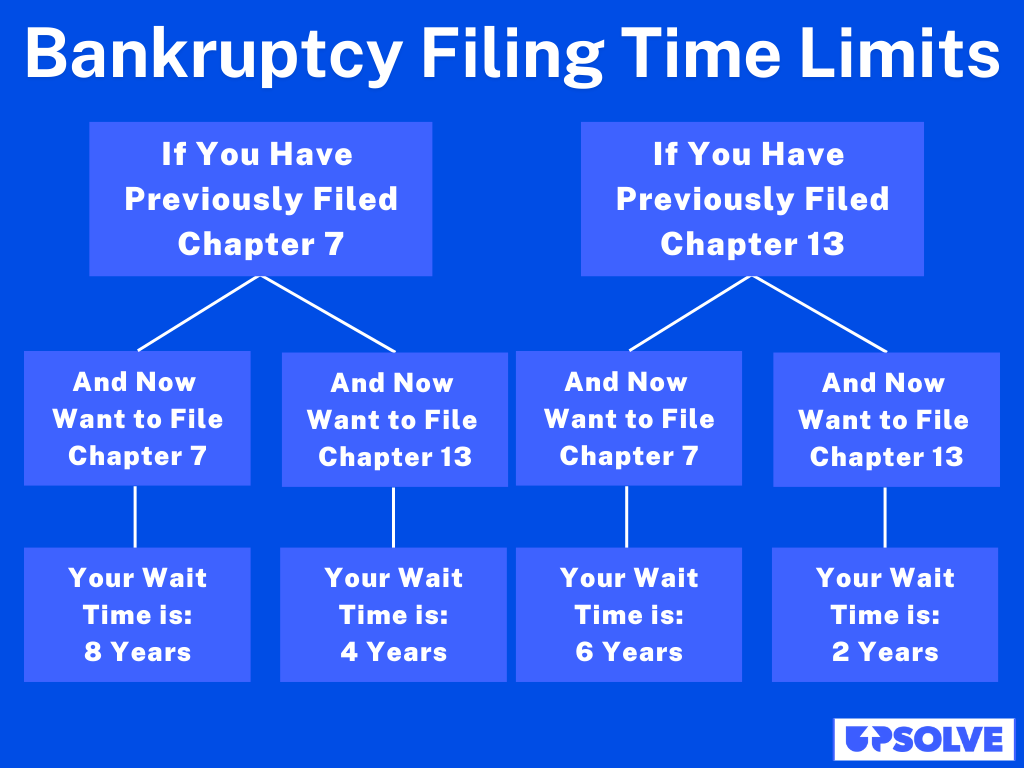

How Many Times Can You File Bankruptcy In A Lifetime

While there is no legal limit on how many times you can file bankruptcy, there is a limit on how often. Depending on wat type of bankruptcy is. Do I Have to Liquidate or Surrender Any of My Property? How Long Does it Take? Can You Only Claim Bankruptcy Once in Your Lifetime? Can I Keep My Home in a. There's no law against filing for bankruptcy twice, thrice or however many times you reach that point of desperation and want a way out. You can only file ONCE in a lifetime. You can file a Chapter 7 bankruptcy eight years after discharge, but discharge restrictions apply. Consult with your. Fortunately, for most individuals filing for bankruptcy only happens once in their lifetime. When you file bankruptcy you will be given the skills needed to. There's always the chance you may find yourself in a financial rut more than once in your lifetime. Luckily, you can file for bankruptcy more than once should. The simple answer? You can receive a Chapter 7 bankruptcy discharge every eight years. But you won't need to wait that long if you filed a different chapter. The truth is that there are normally no limits on how many bankruptcies a person can file, but there are restrictions on the timing of multiple bankruptcies in. An individual can file for Chapter 7 bankruptcy only once in an eight-year period. · Some filers file Chapter 13 petitions soon after Chapter 7, but four years. While there is no legal limit on how many times you can file bankruptcy, there is a limit on how often. Depending on wat type of bankruptcy is. Do I Have to Liquidate or Surrender Any of My Property? How Long Does it Take? Can You Only Claim Bankruptcy Once in Your Lifetime? Can I Keep My Home in a. There's no law against filing for bankruptcy twice, thrice or however many times you reach that point of desperation and want a way out. You can only file ONCE in a lifetime. You can file a Chapter 7 bankruptcy eight years after discharge, but discharge restrictions apply. Consult with your. Fortunately, for most individuals filing for bankruptcy only happens once in their lifetime. When you file bankruptcy you will be given the skills needed to. There's always the chance you may find yourself in a financial rut more than once in your lifetime. Luckily, you can file for bankruptcy more than once should. The simple answer? You can receive a Chapter 7 bankruptcy discharge every eight years. But you won't need to wait that long if you filed a different chapter. The truth is that there are normally no limits on how many bankruptcies a person can file, but there are restrictions on the timing of multiple bankruptcies in. An individual can file for Chapter 7 bankruptcy only once in an eight-year period. · Some filers file Chapter 13 petitions soon after Chapter 7, but four years.

6 years after date that prior bankruptcy case was filed, if less than 70% (and up to %) of claims were not paid in the prior Chapter 13 bankruptcy case –. Legally speaking, a person can file for bankruptcies as many times as they want. However, the process becomes more restrictive. With a second bankruptcy, you. The important takeaway is that people facing financial struggles have the option to file for bankruptcy more than once in their lifetime. The essential. time, usually three years but as long as five. It is usually filed by people who are past due in the home mortgage or car payments. To qualify for Chapter. The law allows you to file Chapter 7 bankruptcy once every eight years, up to a total of three times in your life. Previously Filed Chapter 13 and Filing. How Many Times Can I File Bankruptcy? Life happens. Oftentimes, financial hardship can hit a person more than once during a lifetime. If you have filed. The decision to file for bankruptcy is often one of the hardest choices that a person has to make in his or her lifetime. Poor planning can often make the. You can declare for bankruptcy more than once in your lifetime. The number of times you can file bankruptcy is determined by the length of time since your last. The Bankruptcy Code does not limit the number of bankruptcy cases a person can file; however, it does limit the time period between bankruptcy discharges. A. You may file for bankruptcy protection as many times as necessary during your lifetime. There is no limit on the number of times you may file. There is no limit on the number of times you can file for bankruptcy within your lifetime. However, there is a limit on how often you can get a discharge. Generally speaking, you may file for bankruptcy as many times as you please throughout your lifetime. However, you may be required to wait a certain amount. The bottom line: There are no legal limitations on how many times a person can file bankruptcy. There are just time limitations on when it can be done. Myth #3: I can only file for bankruptcy once in a lifetime. There are no limits regarding how many times you may file for bankruptcy in your lifetime. The. How Many Times Can I File for Bankruptcy in My Lifetime? While there is a waiting period between bankruptcy filings, it's important to note that there is no. There's a myth that an individual can only file for bankruptcy once in their lifetime, but this isn't true. There are no limits on how many times a person. You can only file bankruptcy once in your lifetime – FALSE. Repeat filings Sometimes a client has no choice but to file multiple times, even within a few. For most people, bankruptcy is a once-in-a-lifetime event. However, if you find yourself in financial trouble years after the initial bankruptcy filing, you. Switching Between Chapter 7 and Chapter 13 Bankruptcy · You successfully paid all of your unsecured creditors during your first bankruptcy. Unsecured creditors. “You've taken business bankruptcies six times.” –Hillary Clinton. “On occasion – four times – we used certain laws that are there.” –Donald Trump.

What Is Microfinance

:max_bytes(150000):strip_icc()/microfinance-v2-1306daf1c34c41119198bbc504886140.jpg)

Housing microfinance consists of small, non-mortgage backed loans starting at just a few hundred dollars that can be offered to low-income populations in. Microfinance is a powerful instrument against poverty. Access to sustainable financial services enables the poor to increase incomes, build assets, and. Microfinance refers to the financial services provided to low-income individuals or groups who are typically excluded from traditional banking. Most. The purpose of microfinance is to provide financial services to people generally excluded from traditional banking channels because of their low. Microfinance institutions (MFIs) are organisations that offer financial services to low income populations. Almost all give loans to their members, and many. The formal microfinance banks are required to take license from State Bank of Pakistan under MFIs Ordinance to operate as microfinance bank and are under. Microfinancing is the process of giving small loans to business owners without access to traditional financial products. Learn how microfinancing works. Microfinance is a promising way to address global problems such as poverty, inequality and environmental damage. But what's in it for investors? Microfinance mainly refers to micro-credit. A micro-credit is a small loan which is mainly granted to people with a low income. There is no shortage of. Housing microfinance consists of small, non-mortgage backed loans starting at just a few hundred dollars that can be offered to low-income populations in. Microfinance is a powerful instrument against poverty. Access to sustainable financial services enables the poor to increase incomes, build assets, and. Microfinance refers to the financial services provided to low-income individuals or groups who are typically excluded from traditional banking. Most. The purpose of microfinance is to provide financial services to people generally excluded from traditional banking channels because of their low. Microfinance institutions (MFIs) are organisations that offer financial services to low income populations. Almost all give loans to their members, and many. The formal microfinance banks are required to take license from State Bank of Pakistan under MFIs Ordinance to operate as microfinance bank and are under. Microfinancing is the process of giving small loans to business owners without access to traditional financial products. Learn how microfinancing works. Microfinance is a promising way to address global problems such as poverty, inequality and environmental damage. But what's in it for investors? Microfinance mainly refers to micro-credit. A micro-credit is a small loan which is mainly granted to people with a low income. There is no shortage of.

A credit enhancement and risk-allocation tool, designed to promote local currency lending by commercial banks and financial institutions to microfinance. What is microfinance? Microfinance is a special category of financial services, targeting small businesses and individuals who lack access to traditional. The I-AM Vision Microfinance offers investors access to impact investments and invests primarily in fixed-income investments of carefully selected microfinance. FINCA services help entrepreneurs in developing countries. Examples of microfinance services include: microfinance loans, savings, money transfers, etc. Microfinance includes a number of services, such as savings accounts, checking accounts, fund transfers, microinsurance, and microcredit. Microfinance has helped the financially poor to reduce their susceptibility to external shocks, improved income, and build feasible businesses. Today, the purpose of microfinance is to meet the needs of communities who have been marginalised and are 'unbanked'. In practical terms, this means providing a. Features of Microfinance · They help smaller businessmen from rural or other underdeveloped areas to get access to structured loans · These services are meant. Learn how microfinance helps people access financial services and potentially climb out of poverty and how you can get involved as an individual, investor, or. Microfinance is a type of banking that provides financial services to low income individuals or groups of people who would otherwise have no access to finance. Microfinance is a type of banking that provides financial services to low income individuals or groups of people who would otherwise have no access to finance. "Microfinance is the provision of financial services to the poor on a sustainable basis. Financial services that the working poor need and demand include. A microfinance institution is a provider of credit. However, the size of the loans are smaller than those granted by traditional banks. Microfinance · Conduct thorough research and due diligence on potential MFIs. · Develop a clear repayment plan and budget, based on the projected growth of a. Microfinance SectorMicrofinance is defined as “provision of financial services to low income people” by the Consultative Group to Assist the Poor (CGAP). Key Features of Microfinance · The borrowers are generally from low-income backgrounds · Loans availed under microfinance are usually of small amount, i.e. A: Microfinance and micro credit aim to provide small loans for poor or low-income people to start micro enterprise for poverty alleviation. Microfinance. Purpose: Microfinance loans are for small businesses and low income group individuals. So the main objective of microfinancing institutions is to generate. WHAT IS MICROFINANCE? Microfinance is a financial operation that provides small loans to struggling businesspeople in order to expand their small enterprises.

Lord Abbett Bond Debenture Fund A

FUND. Lord Abbett Bond Debenture Fund Class A. (Load Adjusted). %, % ; PRIMARY BENCHMARK. BBg US Agg Bond. Close. %, % ; SECONDARY BENCHMARK. Lord Abbett Bond-Debenture A has % of its portfolio invested in foreign issues. The overall assets allocated to domestic stock is %. There is %. Analyze the Fund Lord Abbett Bond Debenture Fund Class A having Symbol LBNDX for type mutual-funds and perform research on other mutual funds. The Lord Abbett Ultra Short Bond Fund seeks to deliver current income consistent with the preservation of capital. View portfolio, performance and more. LBNOX Mutual Fund Guide | Performance, Holdings, Expenses & Fees, Distributions and More. The Lord Abbett Core Plus Bond Fund invests in a wide range of fixed income securities with select allocations to non-U.S. debt securities. View portfolio. The fund seeks to deliver high current income and long-term growth of capital. To achieve that, managers invest in a variety of fixed-income securities, along. Performance charts for Lord Abbett Bond-Debenture Fund Inc (LBNDX) including intraday, historical and comparison charts, technical analysis and trend lines. The Fund seeks high current income and capital growth. The Fund allocates its assets principally among fixed income securities in four market sectors. FUND. Lord Abbett Bond Debenture Fund Class A. (Load Adjusted). %, % ; PRIMARY BENCHMARK. BBg US Agg Bond. Close. %, % ; SECONDARY BENCHMARK. Lord Abbett Bond-Debenture A has % of its portfolio invested in foreign issues. The overall assets allocated to domestic stock is %. There is %. Analyze the Fund Lord Abbett Bond Debenture Fund Class A having Symbol LBNDX for type mutual-funds and perform research on other mutual funds. The Lord Abbett Ultra Short Bond Fund seeks to deliver current income consistent with the preservation of capital. View portfolio, performance and more. LBNOX Mutual Fund Guide | Performance, Holdings, Expenses & Fees, Distributions and More. The Lord Abbett Core Plus Bond Fund invests in a wide range of fixed income securities with select allocations to non-U.S. debt securities. View portfolio. The fund seeks to deliver high current income and long-term growth of capital. To achieve that, managers invest in a variety of fixed-income securities, along. Performance charts for Lord Abbett Bond-Debenture Fund Inc (LBNDX) including intraday, historical and comparison charts, technical analysis and trend lines. The Fund seeks high current income and capital growth. The Fund allocates its assets principally among fixed income securities in four market sectors.

View the latest Lord Abbett Bond Debenture Fund;A (LBNDX) stock price, news, historical charts, analyst ratings and financial information from WSJ. Lord Abbett Bond Debenture Fund. MAY 1, CLASS/TICKER. CLASS A • Equity Securities Risk: Equity securities, as well as equity-like securities such. Lord Abbett Bond Debenture Fund Class A (LBNDX) · Add Instrument to: · New Portfolio. Create a New Portfolio. CancelCreate. A high-level overview of Lord Abbett Bond Debenture Fund A (LBNDX) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals. Find the latest Lord Abbett Bond-Debenture A (LBNDX) stock quote, history, news and other vital information to help you with your stock trading and. Get the latest Lord Abbett Bond Debenture Fund Class R4 (LBNSX) real-time quote, historical performance, charts, and other financial information to help you. It may invest a substantial portion of its net assets in high-yield securities (commonly referred to as "below investment grade" or "junk" bonds). The fund may. Lord Abbett Bond Debenture Fund. (Class I). ICE BofA US High Yield Index To obtain a prospectus or summary prospectus on any Lord Abbett mutual fund, contact. Get the latest Lord Abbett Bond Debenture Fund Class P (LBNPX) real-time quote, historical performance, charts, and other financial information to help you. Latest Lord Abbett Bond Debenture Fund Class A (LBNDX) share price with interactive charts, historical prices, comparative analysis, forecasts. The Lord Abbett Series Fund Bond Debenture Portfolio seeks to deliver high current income and long-term growth of capital. View prospectus and more. Get the latest Lord Abbett Bond Debenture Fund Class A (LBNDX) real-time quote, historical performance, charts, and other financial information to help you. Lord Abbett Bond Debenture Fund Class A · Price (USD) · Today's Change / % · 1 Year change+%. Find the latest Lord Abbett Bond Debenture Fund (BDLAX) stock quote, history, news and other vital information to help you with your stock trading and. Find the latest performance data chart, historical data and news for Lord Abbett Bond-Debenture Fund Inc. Cl A (LBNDX) at kurushar.ru The portfolio maintains a cost advantage over competitors, priced within the cheapest fee quintile among peers. Lord Abbett Bond Debenture Fund Class A (04/71). LBNDX. JPMorgan Income Fund Class I (06/14). JMSIX. LBNDX: Lord Abbett Bond-Debenture Fund Inc. Cl A - Fund Profile. Get the lastest Fund Profile for Lord Abbett Bond-Debenture Fund Inc. Cl A from Zacks. Get Lord Abbett Bond Debenture Fund Class A (LBNDX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Find the latest Lord Abbett Bond Debenture Fund (BDLAX) stock quote, history, news and other vital information to help you with your stock trading and.

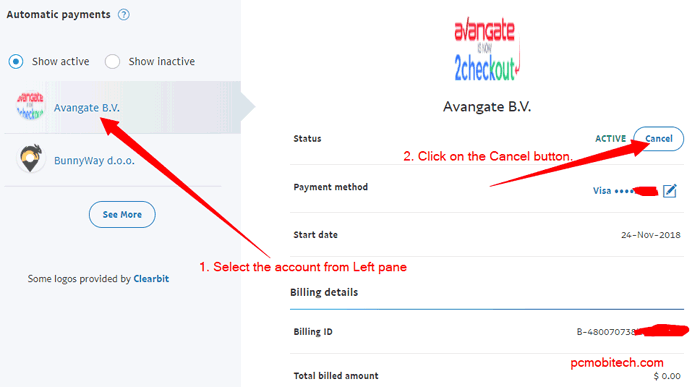

How Do I Cancel Payment On Paypal

Tap image Wallet. · Tap Activity. · Find the payment and tap to open. · Tap Cancel. To cancel a completed payment, contact the seller for a refund or return. If not resolved, open a dispute within the correct dispute-filing timeframe. If you sent a payment to the wrong person and the payment status shows as unclaimed, you can cancel it. Go to your Activity, find the payment, and click Cancel. I sent payment and it was stattused as pending because of using revolut on paypal possibly.. the guy cancel parcel after not receiving money directly but I. Click Manage pre-approved payments. It's in the center of the window. You cannot cancel a PayPal payment! To get your money back: Until you do this there is nothing you can do as at this stage it is just 'buyer remorse.'. Go to Settings. Click Payments. Select Automatic payments. Select the merchant. On this page, you can cancel. Tap image Wallet. · Tap Activity. · Find the payment and tap to open. · Tap Cancel. Open your Activity History · Choose the transaction you wish to cancel and click on the transaction ID · Click the Cancel icon and confirm the action on the pop-. Tap image Wallet. · Tap Activity. · Find the payment and tap to open. · Tap Cancel. To cancel a completed payment, contact the seller for a refund or return. If not resolved, open a dispute within the correct dispute-filing timeframe. If you sent a payment to the wrong person and the payment status shows as unclaimed, you can cancel it. Go to your Activity, find the payment, and click Cancel. I sent payment and it was stattused as pending because of using revolut on paypal possibly.. the guy cancel parcel after not receiving money directly but I. Click Manage pre-approved payments. It's in the center of the window. You cannot cancel a PayPal payment! To get your money back: Until you do this there is nothing you can do as at this stage it is just 'buyer remorse.'. Go to Settings. Click Payments. Select Automatic payments. Select the merchant. On this page, you can cancel. Tap image Wallet. · Tap Activity. · Find the payment and tap to open. · Tap Cancel. Open your Activity History · Choose the transaction you wish to cancel and click on the transaction ID · Click the Cancel icon and confirm the action on the pop-.

This article explains how to cancel your subscription: the recurring payment is removed for your profile and your Form Publisher license won't be renewed. You can cancel unwanted Paypal payments and get your money back if you act quick enough. The article below will help you figure out step by step how to stop a. Go to Activity. · Click Cancel under the payment in question. · Follow the steps to cancel the payment. Go to Settings. Click Payments. Select Automatic payments. Select the merchant. On this page, you can cancel the automatic payment and change the backup. Open your Activity History; Choose the transaction you wish to cancel and click on the transaction ID; Click the Cancel icon and confirm the action on the pop-. Open your Activity History · Choose the transaction you wish to cancel and click on the transaction ID · Click the Cancel icon and confirm the action on the pop-. How do I cancel a PayPal or Venmo payment? ← General. If you made a payment via a third-party payment provider like PayPal or Venmo, you'll need to cancel the. Once you authorize a transfer from your bank account to your PayPal account, you can't cancel it. Once the money is in your PayPal Balance or PayPal. Log in to your PayPal account via a desktop browser. · Click the Settings icon (cogwheel) in the top right-hand corner. · Select Payments. · Click on Manage. In order to cancel the subscription payment on PayPal for any of your clients, log into your PayPal account and go to Send & Request Payments as seen in the. Tap Accounts. · Tap Autopay. · Tap the merchant to view or update. · Tap Remove PayPal as your payment method. Click Manage pre-approved payments. It's in the center of the window. To cancel a completed payment, contact the seller for a refund or return. If not resolved, open a dispute within the correct dispute-filing timeframe. Unfortunately, once an instant bank transfer is initiated on PayPal, it's not possible for the sender to cancel it before the recipient receives. Log in to your PayPal account via a desktop browser. · Click the Settings icon (cogwheel) in the top right-hand corner. · Select Payments. · Click on Manage. Once you've requested a withdrawal from your PayPal account, you can't cancel it. If the transfer is complete and you need the money in your PayPal account. You can cancel a payment you've sent if its status is 'Unclaimed' in the 'Payment Status' column. 'Unclaimed' means the recipient has not received or accepted. You can cancel a PayPal Credit payment before the scheduled date by logging in, clicking on PayPal Credit, selecting the payment, and clicking cancel. 1. Log in to your PayPal account. 2. Click on the "Activity" tab at the top of the page. 3. Locate the transaction you want to cancel and click. Click the word “Cancel” under the pending payment transaction. A prompt will appear that asks you to confirm the payment cancellation. Click “Cancel payment” to.

Should I Refinance Or Not

Refinancing will reduce your monthly mortgage payment by $ By refinancing, you'll pay $49, more in the first 5 years. Personal loan refinancing may not be a good idea if it results in higher overall interest charges. This means you're paying more money to the lender at an. Refinancing can save you money if you get a lower interest rate, but you could also end up paying more if you refinance simply to extend the loan term. The accepted rule of thumb has always been that it was only worth refinancing if you could reduce your interest rate by at least 2%. Today, though, even a 1%. The best time to refinance is usually when you can get a lower interest rate1 than the one available on your existing loan. However, the decision isn't always. Refinancing could lower your interest rate, change your loan type, adjust your repayment term, or cash out available equity. Visit Citizens to learn about. One of the primary benefits of refinancing is the ability to reduce your interest rate. A lower interest rate may mean lower mortgage payments each month. Plus. Refinancing may be able to lower your monthly payments, shorten the term of your loan, or offer a bit more financial security. Award Winning Calculator determines if Refinancing makes sense using live mortgages and real data. Find out now exactly how much you can save or cash out. Refinancing will reduce your monthly mortgage payment by $ By refinancing, you'll pay $49, more in the first 5 years. Personal loan refinancing may not be a good idea if it results in higher overall interest charges. This means you're paying more money to the lender at an. Refinancing can save you money if you get a lower interest rate, but you could also end up paying more if you refinance simply to extend the loan term. The accepted rule of thumb has always been that it was only worth refinancing if you could reduce your interest rate by at least 2%. Today, though, even a 1%. The best time to refinance is usually when you can get a lower interest rate1 than the one available on your existing loan. However, the decision isn't always. Refinancing could lower your interest rate, change your loan type, adjust your repayment term, or cash out available equity. Visit Citizens to learn about. One of the primary benefits of refinancing is the ability to reduce your interest rate. A lower interest rate may mean lower mortgage payments each month. Plus. Refinancing may be able to lower your monthly payments, shorten the term of your loan, or offer a bit more financial security. Award Winning Calculator determines if Refinancing makes sense using live mortgages and real data. Find out now exactly how much you can save or cash out.

Generally, a mortgage refinance is a good idea if it will save you money. Mortgage experts say you should consider this move if you can lower your interest. Refinancing can help homeowners cash out some of their home's equity, obtain lower interest rates, or reduce their monthly payments. The best time to refinance a mortgage is when you financially benefit from refinancing. This means you should probably wait to refinance your mortgage. One of the main advantages of refinancing regardless of equity is reducing an interest rate. Often, as people work through their careers and continue to make. If rates drop significantly and can result in substantial savings, then refinancing is worth considering. However, it's crucial to weigh the. Refinancing can be a great financial move if it reduces your mortgage payment or shortens your loan term. However if you want to lower your overall mortgage expense, refinancing may not make sense- there are always closing costs, even with a no-cost refinance, so. Refinancing your mortgage means renegotiating your existing mortgage loan agreement. You might do this to consolidate debts, or you could use the equity in. Refinancing your home can be a great financial move if it shortens the term of your loan, reduces your mortgage payment, or helps you build equity more quickly. Refinancing is one way to shorten the term of your loan. Keep in mind that refinancing is often not necessary to pay off your mortgage quicker. You can also. Generally, if you can get a rate that is at least one to two percent less than your existing rate, you can consider refinancing your mortgage. No rule of thumb. When is Refinancing Worth it? Refinancing is only worth it if by doing so you put yourself in a more positive financial position as a homeowner. Ultimately it. Award Winning Calculator determines if Refinancing makes sense using live mortgages and real data. Find out now exactly how much you can save or cash out. Reasons you may want to refinance · To lower your mortgage payment. · To lower the amount of interest you'll pay overall. Refinancing may also reduce the total. Should I refinance? Whether or not you should refinance depends on your specific circumstances. Refinancing at the right time can help you save money, either. Generally, refinancing every few years is a smart move to ensure you still have a competitive home loan as your situation, and the financial climate, changes. If you plan on moving anytime soon, it's not a wise decision to refinance your mortgage. Selling too soon after refinancing means you won't live in your home. Learn what you should consider when you're thinking about refinancing your home mortgage with help from U.S. Bank. Refinancing your mortgage could save you. The general rule is that if you are planning on staying in your home for longer than the break-even point, it's a good idea to refinance. The accepted rule of thumb has always been that it was only worth refinancing if you could reduce your interest rate by at least 2%.

How To Get A Cheap Lease

Leasing a car is much cheaper than buying it outright, because you're only paying a percentage of the total price. You won't have to worry about fetching a good. One angle that works for many car buyers is leasing. A lease agreement is a simple and hassle-free way to get lower monthly payments on the vehicle you're. Whether you're looking for a new SUV, truck or sedan, we have affordable options for you on our list of this month's cheapest lease deals. Leasing offers a fun alternative to buying. It's more of a short-term commitment that gives you the opportunity to upgrade every few years. It starts by. A car lease is a type of vehicle financing that doesn't tie you into buying a car. You can finance for a few years and then simply turn your car in at the end. If you can, try different approaches to raise your score before applying for an auto loan or lease. · Have at least a 20% down payment saved. · Prepare for higher. Call, text or email the leasing department of local dealerships and ask for prices on the inventory you're interested in. Be sure to. These lease offers can vary by region, so check the manufacturer's website to find out what is available in your area. All prices are for the trim level on. Cheapest Small Car Leases ; Hyundai Elantra SE >. image of Hyundai Elantra SE · $ · $3, · $ ; Subaru Impreza Base >. image of Subaru. Leasing a car is much cheaper than buying it outright, because you're only paying a percentage of the total price. You won't have to worry about fetching a good. One angle that works for many car buyers is leasing. A lease agreement is a simple and hassle-free way to get lower monthly payments on the vehicle you're. Whether you're looking for a new SUV, truck or sedan, we have affordable options for you on our list of this month's cheapest lease deals. Leasing offers a fun alternative to buying. It's more of a short-term commitment that gives you the opportunity to upgrade every few years. It starts by. A car lease is a type of vehicle financing that doesn't tie you into buying a car. You can finance for a few years and then simply turn your car in at the end. If you can, try different approaches to raise your score before applying for an auto loan or lease. · Have at least a 20% down payment saved. · Prepare for higher. Call, text or email the leasing department of local dealerships and ask for prices on the inventory you're interested in. Be sure to. These lease offers can vary by region, so check the manufacturer's website to find out what is available in your area. All prices are for the trim level on. Cheapest Small Car Leases ; Hyundai Elantra SE >. image of Hyundai Elantra SE · $ · $3, · $ ; Subaru Impreza Base >. image of Subaru.

When you visit our website, we use cookies and other mechanisms, such as session replay technology, to collect information. The data collected is used to. The typical auto lease term is months. Leases can be structured to include a down payment or even with zero money down. Remember, the less money you put. $ FOR YOUR LEASE TURN-IN. Receive $ just for turning in your vehicle at Honda East, even if you didn't purchase your Honda from us. · WINDSHIELD CHIP. Try shopping for leases on new cars first, then newer used cars, because these are the vehicles that usually have the lowest interest or lease rates. Remember. SUV $ Lease Deals ; Alfa Romeo Tonale · $47, · $ per month for 24 months · $5, · National (Lease price varies by state) ; Buick Encore GX. Why Lease a New Car? If you like to drive newer, safer, more reliable cars, trucks, or SUVs, not pay a considerable down payment every years, and also don. Cars with the Cheapest Lease Payment · Hyundai Elantra · Kia Forte · Volkswagen Jetta · Hyundai Sonata · Subaru Impreza · Hyundai Kona. Car leasing is similar to renting, although you have the option to purchase the vehicle at the end of your lease term for a pre-negotiated price. Is Leasing. What is Leasing? A vehicle easing contract allows you to rent a car for a period of time, usually years. This makes it an affordable way. Leasing a car gets you a brand new car at an affordable price. You make payments for a pre-determined lease period and return it at the end of your lease. After. Unlike a traditional car purchase, you don't actually own the vehicle. Instead, a leasing company purchases the vehicle from the dealer on your behalf and then. In order to receive the internet price, you must bring in this advertisement and have the price referenced in your contract at the time of purchase or lease. Car or truck lease payments are often less expensive compared to auto loan and car financing payments as the normal lease deal is more-or-less renting with the. Though leasing is cheaper monthly, buying a vehicle is often cheaper in the long-run if you tend to keep your vehicles long enough past the date that payment. Leasing allows you to drive a new vehicle around Warren, MI, and beyond for an agreed-upon term limit. Usually, lease terms are two to three years. You'll pay a. While leasing is not for everyone, there are some great advantages of leasing as opposed to buying. And with our Sign & Drive program, you can now get a lease. WB Lease Mo 0 Down Available. Here we have a Toyota Tundra with an MSRP of It is a Truck and you can get it today for $0 Due. A lease deal lets you get the exact car you want without the commitment of car ownership. See Toyota lease deals near you today. Take Over a Lease. Take over a Lease. Search new and used car lease deals. SEARCH LEASES.

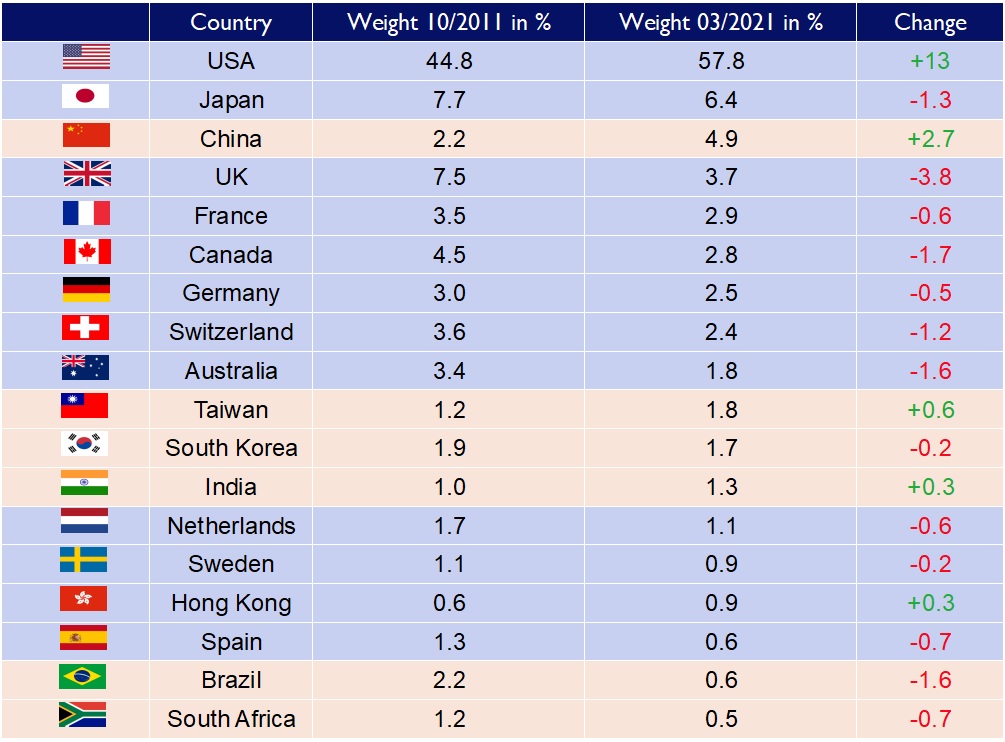

Msci Ac Wi

The ETF's TER (total expense ratio) amounts to % p.a.. The iShares MSCI ACWI UCITS ETF USD (Acc) is the largest ETF that tracks the MSCI All Country World . Explore ACWI for FREE on ETF Database: Price, Holdings, Charts, Technicals, Fact Sheet, News, and more. The MSCI ACWI Investable Market Index (IMI) is a widely quoted global equity index. Approximately USD trillion in assets are benchmarked to the ACWI as. As of August , in the previous 30 Years, the iShares MSCI ACWI ETF (ACWI) ETF obtained a % compound annual return, with a % standard deviation. It. iShares MSCI ACWI ETF. ACWI tracks a market cap-weighted index of large- and mid-cap global stocks, covering 85% of the developed and emerging markets. MSCI ACWI intro. The MSCI ACWI Index, MSCI's flagship global equity index, is designed to represent performance of the full opportunity set of large- and mid-. Find the latest iShares MSCI ACWI ETF (ACWI) stock quote, history, news and other vital information to help you with your stock trading and investing. Performance charts for iShares MSCI ACWI ETF (ACWI - Type ETF) including intraday, historical and comparison charts, technical analysis and trend lines. The MSCI All Country World Index (MSCI ACWI) is an international equity index, which tracks stocks from 23 developed and 24 emerging markets countries. This. The ETF's TER (total expense ratio) amounts to % p.a.. The iShares MSCI ACWI UCITS ETF USD (Acc) is the largest ETF that tracks the MSCI All Country World . Explore ACWI for FREE on ETF Database: Price, Holdings, Charts, Technicals, Fact Sheet, News, and more. The MSCI ACWI Investable Market Index (IMI) is a widely quoted global equity index. Approximately USD trillion in assets are benchmarked to the ACWI as. As of August , in the previous 30 Years, the iShares MSCI ACWI ETF (ACWI) ETF obtained a % compound annual return, with a % standard deviation. It. iShares MSCI ACWI ETF. ACWI tracks a market cap-weighted index of large- and mid-cap global stocks, covering 85% of the developed and emerging markets. MSCI ACWI intro. The MSCI ACWI Index, MSCI's flagship global equity index, is designed to represent performance of the full opportunity set of large- and mid-. Find the latest iShares MSCI ACWI ETF (ACWI) stock quote, history, news and other vital information to help you with your stock trading and investing. Performance charts for iShares MSCI ACWI ETF (ACWI - Type ETF) including intraday, historical and comparison charts, technical analysis and trend lines. The MSCI All Country World Index (MSCI ACWI) is an international equity index, which tracks stocks from 23 developed and 24 emerging markets countries. This.

Historical analysis of the MSCI ACWI index between December and July Find the latest quotes for iShares MSCI ACWI ETF (ACWI) as well as ETF details, charts and news at kurushar.ru The iShares MSCI ACWI ETF (ACWI) is an exchange-traded fund that is based on the MSCI AC World index. The fund tracks a market cap-weighted index of large- and. ACWI Performance - Review the performance history of the iShares MSCI ACWI ETF to see it's current status, yearly returns, and dividend history. The MSCI ACWI Investable Market Index (IMI) captures large, mid and small cap representation across 23 Developed Markets (DM) and. 24 Emerging Markets (EM). MSCI ACWI - All Country World (ZB_): Stock quote, stock chart, quotes, analysis, advice, financials and news for Index MSCI ACWI - All Country. The MSCI ACWI captures large and mid cap representation across 23 Developed and 24 Emerging Markets countries*. With 2, constituents, the index covers. ACWI. iShares MSCI ACWI ETF. Fact Sheet as of Jun The iShares MSCI ACWI ETF seeks to track the investment results of an index composed of large and. MSCI ACWI Net USD offers exposure to a diversified basket of stocks, which can be appealing for investors seeking broad market exposure. Investing in the index. Current and Historical Performance Performance for iShares MSCI ACWI ETF on Yahoo Finance. The fund tracks the MSCI All Country World Index. It holds large- and mid-cap stocks listed in developed and emerging markets and weights them by market cap. The iShares MSCI ACWI ETF seeks to track the investment results of an index composed of large and mid-capitalization developed and emerging market equities. Get iShares MSCI ACWI ETF (ACWI:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. The MSCI All Country World Index (ACWI) is a global equity index that measures the equity performance in both the developed and emerging markets. By the end of. About iShares MSCI ACWI ETF BlackRock, Inc. ACWI offers a broad portfolio of global large- and mid-cap stocks that matches the market well. The fund tracks. ACWI, USD, , , ; ACWI ex, USA, USD, , , Latest iShares MSCI ACWI ETF (ACWI:NMQ:USD) share price with interactive charts, historical prices, comparative analysis, forecasts, business profile and. The SPDR® MSCI ACWI ex-US ETF seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of. ACWI | A complete iShares MSCI ACWI ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing. Annual Total Returns Versus Peers ; Name. ; iShares MSCI ACWI ETF. %. %. %. % ; MSCI ACWI Ex USA Net Total Return.

What Is Reconciliation Account

Reconciliation accounts are gl accounts when u post business transactions to subsidiary ledgers in real time system automatically updates same data in gl. An account reconciliation refers to the process of reconciling an account balance to specified source data to ensure a balance is complete and accurate. Reconciling account is an accounting process that is used to prove that the transactions adding up to the ending balance are correct. To be effective, a bank reconciliation statement should include all transactions that impact a company's financial accounts. Let FreshBooks Crunch The Numbers. Reconciling account is an accounting process that is used to prove that the transactions adding up to the ending balance are correct. Account reconciliation is the process of comparing and aligning two sets of financial records to ensure that they are accurate, complete, and consistent. Account reconciliation refers to the process of comparing internal financial records with external monthly statements to ensure they agree. Reconcillation account is a sub account which is assign to vendors and it is parallely updated along wiht the vendor account. Reconciliation is a fundamental accounting process that ensures the actual money spent or earned matches the money leaving or entering an account at the end of. Reconciliation accounts are gl accounts when u post business transactions to subsidiary ledgers in real time system automatically updates same data in gl. An account reconciliation refers to the process of reconciling an account balance to specified source data to ensure a balance is complete and accurate. Reconciling account is an accounting process that is used to prove that the transactions adding up to the ending balance are correct. To be effective, a bank reconciliation statement should include all transactions that impact a company's financial accounts. Let FreshBooks Crunch The Numbers. Reconciling account is an accounting process that is used to prove that the transactions adding up to the ending balance are correct. Account reconciliation is the process of comparing and aligning two sets of financial records to ensure that they are accurate, complete, and consistent. Account reconciliation refers to the process of comparing internal financial records with external monthly statements to ensure they agree. Reconcillation account is a sub account which is assign to vendors and it is parallely updated along wiht the vendor account. Reconciliation is a fundamental accounting process that ensures the actual money spent or earned matches the money leaving or entering an account at the end of.

We've put together 8 easy steps for making your accounts payable reconciliation easy (and accurate). The definition of reconciliation in accounting is the act of verifying that two sets of records (usually the balances in two accounts) are identical, or. Reconciliation accounts are G/L accounts to which postings are made automatically whenever a business transaction is entered on a subledger account (such as. Account reconciliation is the process of comparing general ledger accounts for the balance sheet with supporting documents like bank statements, sub-ledgers. Account reconciliation refers to the process of comparing internal financial records with external monthly statements to ensure they agree. Account reconciliation refers to the process of comparing internal financial records with external monthly statements to ensure they agree. Account reconciliation controls are key controls that every company should have implemented in a business process. Other key controls include segregation of. We've put together 8 easy steps for making your accounts payable reconciliation easy (and accurate). Account reconciliation is a fundamental accounting process that ensures the integrity of financial transactions. Learn what reconciling is and how reconciliations keep your QuickBooks accounts accurate. When you reconcile, you compare two related accounts make sure. Examples of Reconciling an Account. When a company reconciles its bank statement, it is reconciling the balance in its general ledger account Cash (or Cash. General Ledger (GL) reconciliations work by comparing GL account balances for balance sheet accounts reconciliation because it will show what reconciling. The reconciliation process happens at the end of every reporting period--monthly, quarterly and annually--to ensure every GL account matches the balance of its. A reconciliation account is a balance sheet general ledger account that serves as a summary account or control account. How to do an account reconciliation · Navigate to Accounting > Reconciliation in the left-hand menu. · Look for the account you'd like to reconcile. · Click Get. Reconciliation in accounting is the process of comparing multiple sets of financial records (such as the balances and transactions recorded in bank statements. Different types of account reconciliation Reconciliation is applied to numerous accounts and relationships within an organization. Common forms of. For example, the internal record of cash receipts and disbursements can be compared to the bank statement to see if the records agree with each other. The. Reconciliation also assures that the general ledger accounts are accurate, consistent, and complete. However, besides business, reconciliation can be employed. Get a copy of the current statement for the account you are reconciling. · Make sure that last month's ending balance in your accounting software or ledger shows.

How To Be The Best Financial Advisor

Where to look for a financial adviser · CFP Board. The CFP Board also lists vetted advisers — you can sort by criteria such as location, gender, etc. · kurushar.ru Advisors have access to some top-tier newsletters, offering high-quality content on a wide range of topics written by industry professionals and experts. Bankrate evaluated dozens of financial advisory firms and identified some of the best to consider for your various financial needs. The best way to see what a financial adviser offers is to read their Financial Services Guide (FSG). Look for this information on their website or ask them for. A major part of a personal financial advisor's job is making clients feel comfortable. Advisors must establish trust with clients and respond well to their. What's the best financial advisor certification to advance your career? Learn how professional designations for financial advisors, wealth managers. One of the best ways advisors can win new clients is by stepping up personal involvement in their communities. Whereas traditional marketing campaigns cost. Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making. Barron's annual ranking of the top financial planning advisors. The ranking reflects the volume of assets overseen, revenues generated for the. Where to look for a financial adviser · CFP Board. The CFP Board also lists vetted advisers — you can sort by criteria such as location, gender, etc. · kurushar.ru Advisors have access to some top-tier newsletters, offering high-quality content on a wide range of topics written by industry professionals and experts. Bankrate evaluated dozens of financial advisory firms and identified some of the best to consider for your various financial needs. The best way to see what a financial adviser offers is to read their Financial Services Guide (FSG). Look for this information on their website or ask them for. A major part of a personal financial advisor's job is making clients feel comfortable. Advisors must establish trust with clients and respond well to their. What's the best financial advisor certification to advance your career? Learn how professional designations for financial advisors, wealth managers. One of the best ways advisors can win new clients is by stepping up personal involvement in their communities. Whereas traditional marketing campaigns cost. Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making. Barron's annual ranking of the top financial planning advisors. The ranking reflects the volume of assets overseen, revenues generated for the.

Benefits of working with a financial advisor · 1. Create a customized long-term strategy · 2. Provide a holistic approach to your finances · 3. Plan your. Email is perfect for cross-selling financial products. Use your list to: If you're a financial advisor at a bank, consider beginning to build awareness about. WHAT SERVICES DO YOU OFFER? WILL YOU HAVE A FIDUCIARY DUTY TO ME? WHAT IS YOUR APPROACH TO FINANCIAL PLANNING? Vow to become better organized and to run your practice like a business. Develop a routine or schedule that works for you. Reserve time on your calendar for. One of the biggest reasons financial advisors fail to earn the amount of money you want is because you don't prospect enough. As an advisor, your income largely. Examples of financial advisor niches include retirement planning, estate planning, tax planning, investment management, small business financial consulting. Our directory of financial planners, tax accountants, insurance specialists, and other financial professionals includes some of the top money advisers in the. Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making. We have created this list of 40 Financial Advisor Websites that you will love! 1. Stash Wealth Why it works: The black and red color scheme is used. The easiest way to find the right financial advisor is to use a financial advisor registry like Paladin Research and Registry. When looking for a financial advisor, it's important to consider their qualifications and experience level. You should also consider looking for a local. Your Financial Consultant can help you choose the right level of advice and service based on your goals, and connect you to specialists when you have more. About Personal Advisor Select · $K in minimum assets · $30 advisory fee (cost per $10, annually) · Dedicated Certified Financial Planner™ (CFP®) · Guidance in. WHAT SERVICES DO YOU OFFER? WILL YOU HAVE A FIDUCIARY DUTY TO ME? WHAT IS YOUR APPROACH TO FINANCIAL PLANNING? Your best interest is our only interest. Financial Advisors have a duty to work in the client's best interests. Something we take very seriously at Morgan. The top qualifications IFAs can get is Certified Financial Planner or Chartered Financial Planner, which put them up there with accountants. For a full list of. This website is only intended for clients and interested investors residing in states in which the Financial Advisor is registered. Janney Financial Advisors. The Fiduciary Standard · Types of Financial Advisers · How Much Help Do You Need? · Find a Qualified Adviser · Do Your Due Diligence · Try It Before You Buy It · Read. Financial is headquartered in Wayzata, Minnesota with additional offices in Elk River. We work with clients across Minnesota and the US.

1 2 3 4 5 6 7